Use our Calculator to Determine your Payment Plan!

Solar Panel Payments Calculator

Use Our Calculator to Determine your Payment Plan!

Solar Financing Re-Payments Schedule

Two columns

Vertical

Horizontal

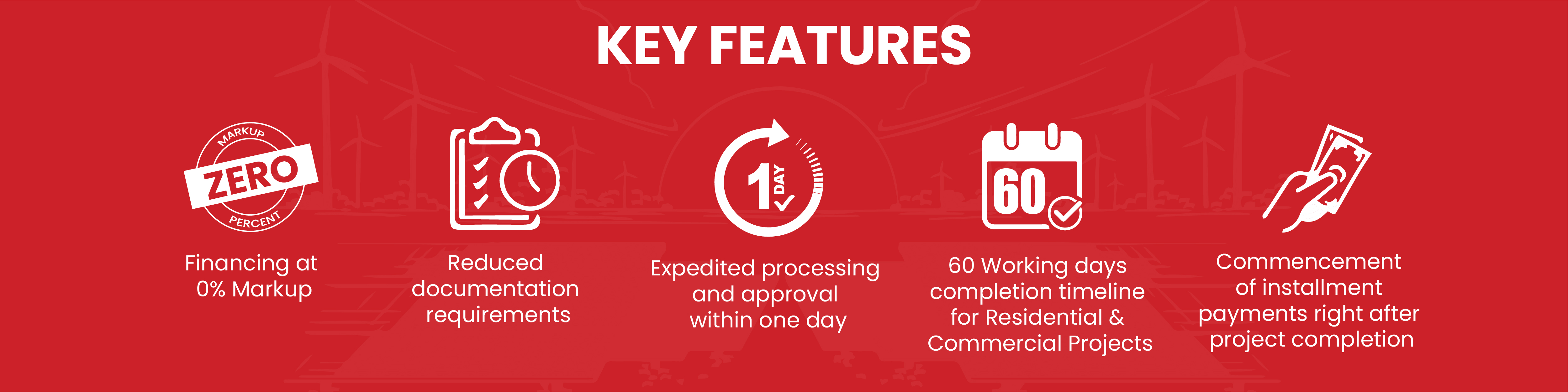

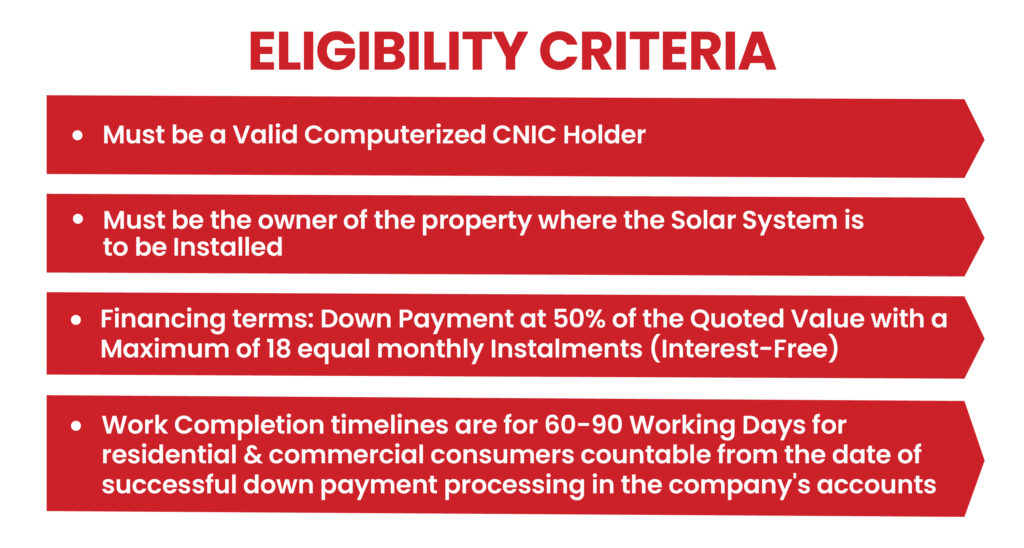

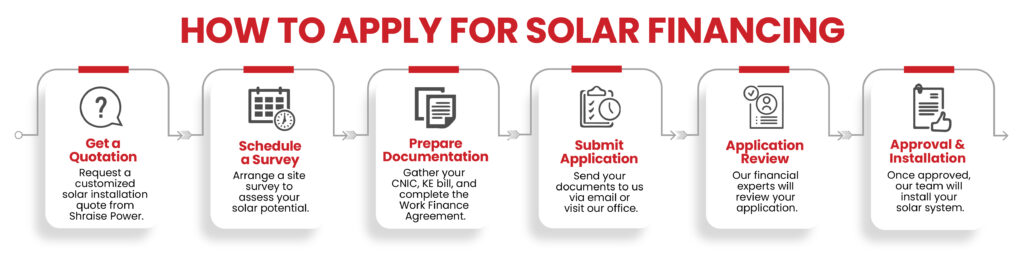

Shraise Solar Financing Program

Financing Summary

Name

Total

{{ field.label }}

{{ field.converted }}

{{ field.label }}

{{ field.converted }}

{{ field.extraView }}

{{ field.option_unit }}

{{ option.label }}

{{ option.converted }}

Total

{{ item.data.converted }}

“{{getWooProductName}}” has been added to your cart